This could result in the provider having to pay for damages it tried to deny coverage or a policyholder might have to pay for damages that the arbitrator ruled were not included in the insurance. Often liability is hotly contested by the involved drivers.

Low Ball Insurance Estimates How To Handle Them After A Car Accident

You cant force the insurance company to go to arbitration and they cant usually.

Arbitration car insurance. Your car insurance policy may spell out more specific steps or the process may be dictated by the laws of your state. In some cases that blame can be divided. Arbitration is different from car accident claim mediation with the main variant being that a mediator only tries to facilitate a resolution between the parties.

The Agreement to Arbitrate. In mandatory binding arbitration companies like car dealerships require consumers to sign contracts with a mandatory binding arbitration agreement in the contract where the consumer agrees to give up their right to sue in court and are bound to use the arbitration process to. Progressive claims rules mandate arbitration to settle first-party claim disputes.

Annonce Employee Discounts Available. Less formal than a courtroom trial arbitration is a legal proceeding where you and the insurance company present information about your claim to a neutral referee known as an arbitrator. The arbitrator reviews the facts and comes to a decision about how to resolve the dispute.

Considered a last-ditch approach before a lawsuit is filed arbitration allows both the driver and the insurance company to present their case before a neutral third-party referee known as an arbitrator. This is a dispute with your insurance company. Arbitration is a method of Alternative Dispute Resolution ADR where a neutral person is chosen to hear both sides of a disagreement and decide the outcome.

Instead of filing a lawsuit the insurer and the policyholder both present their case to the arbitrator. An arbitration clause is a paragraph within an insurance policy that states both parties the insured and the insurance company or the insured and the third party filing the claim will settle their differences. It is a process in which the insured.

Arbitration is common in a disputed car accident claim. Arbitration is a form of alternative dispute resolution ADR. The AAA can provide a list of professional arbitrators who by law are required to be neutral third parties.

Agreeing on an arbitrator often involves a fair amount of back-and-forth between you and your insurer. South Carolina Virginia and Wash-ington all feature language voiding. Arbitration awards are generally legally binding and not appealable.

The mediator has no authority to rule for either side while the arbitrator does have that power. Most car insurance policies let you resolve your dispute through an out-of-court process called arbitration. What Is Insurance Arbitration in Car Insurance.

Arbitration only occurs when both sides agree to it. Your insurance company will respond and the arbitrators will make a decision that binds the parties and resolves the dispute. In most car accidents the person at fault is responsible for paying for the losses of the other.

Others Saved an Avg. A mandatory arbitration clause in the insurance policy covering construction risks especially if the clause requires binding arbitration of all disputes under the policy including coverage disputes. Of 591Year w MetLife Auto.

Arbitration clauses are often found in business insurance policies including commercial auto general liability and workers compensation. In other cases there is a dispute about how much money the claim should be. In arbitration both parties choose a neutral third party to listen to each side of the case and decide.

Arbitration is mandatory in the event of a any collision between vehicles or b any involuntary damage to property involving vehicles or c any such claim against an authorised insurer who in accordance with the Motor Vehicles Insurance Third-Party Risks Ordinance Cap. Car insurance dispute arbitration is faster and cheaper than litigation with cost ranging between 750 to 3500 within 90 days. This is called insurance arbitration.

The car accident arbitration process exists to allow drivers to dispute car insurance matters without escalating to the courtroom. Arbitration may be used to settle an insurance dispute between an insurance provider and a policyholder. Arbitration of disputes involving rein-suranceand other forms of risk trans-fer between insurance companies is usually not restricted presumably on that theory that it constitutes insur-ance between consenting adults9 But some states exemptions are not so circumscribed and at least arguably apply to reinsurance contracts as well.

104 or any policy of insurance may be liable therefor and d the value whereof does not exceed 1164687. Arbitration could be your best go-to in resolving your car insurance dispute. Others Saved an Avg.

During a car insurance arbitration hearing you will be able to demonstrate the cost of the damages to your car and why your insurance company owes what you allege they do. Annonce Employee Discounts Available. Arbitration often comes into play when car accident claims are in dispute whether under your own auto policy or with the at-fault drivers insurance company.

When there are situations and disputes like this it becomes necessary for a third party to make decisions in the matter. Despite what the drivers may say as to how the accident occurred the insurance carriers may agree to who is at fault or how to apportion. Of 591Year w MetLife Auto.

The insurance companies agree to go to arbitration where they each submit their evidence to determine how to apportion the fault for the car crash.

How Long Do You Have To Report A Car Accident Findlaw

The Tricky Business Of Determining Fault After A Car Accident Forbes Advisor

How Do I Deal With Car Insurance Disputes Autoinsurance Org

Geico Vs Progressive Which Provider Is Best 2021

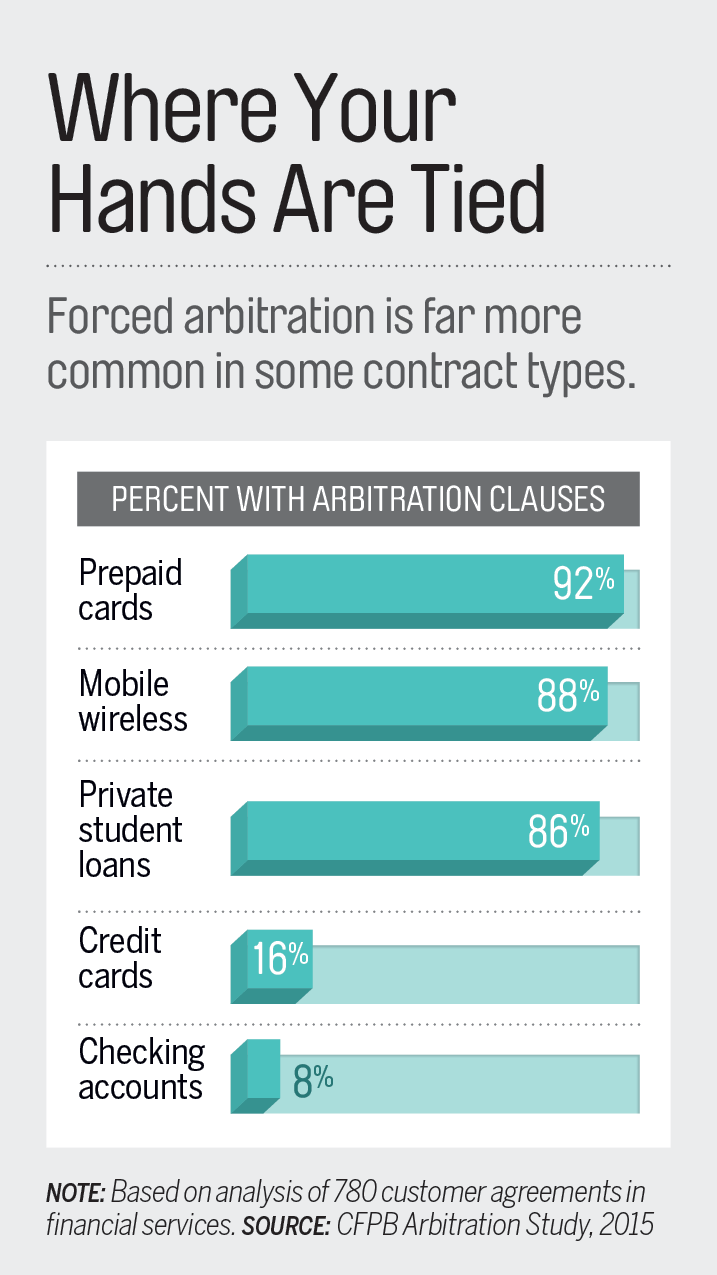

Forced Arbitration How To Fight Back Against Big Companies Money

Filing Claims Under Your Own Policy Department Of Financial Services

The Tricky Business Of Determining Fault After A Car Accident Forbes Advisor

The Arbitration Process Insurance Overview

Increasing Suits To Avoid Arbitrator Administrator Selection Clauses In California Uim Arbitration And Possible Responses Freeman Mathis Gary

My Vehicle Is A Write Off Now What Insurancehotline Com

Arbitration Delaware Department Of Insurance State Of Delaware

How To Fight An Insurance Company Over A Totaled Car

Arbitration Of Car Accident Claims Who Is At Fault

Insurance Arbitration And Litigation In Alabama Florida And Louisiana

Average Settlement From Wrongful Death From Car Accident Lawsuit

How Long Does Car Accident Arbitration Take Lane Lane Llc

Three Stages In The Auto Insurance Claim Process

The Tricky Business Of Determining Fault After A Car Accident Forbes Advisor

:max_bytes(150000):strip_icc()/GettyImages-sb10069770n-003-8887a6d0f562451e9db22f3c1992ccb0.jpg)